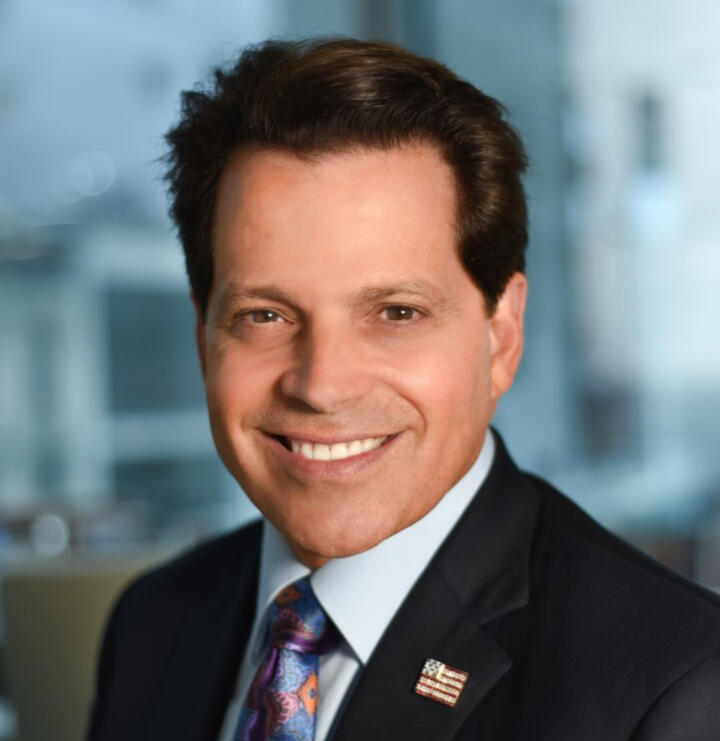

Tariq Fancy

Outcomes > Kumbaya

A builder and educator reshaping how we think about finance, sustainability, and impact.

About

I’ve spent my career inside systems—finance, tech, Wall Street, Silicon Valley—learning how they really work, not how they’re supposed to.That path led me to BlackRock, where I was the first global chief investment officer (CIO) for sustainable investing. I believed in the stated goals, but the deeper I got, the more obvious it became: the system wasn’t built to solve the problems it claimed to. So I spoke up—publicly—and helped spark a debate that’s still playing out in boardrooms and business schools.Now that greenwashing has been exposed and ESG is out of fashion, green assets that lack strong economic fundamentals are under serious pressure, just as I warned they would be.I started my career as a dotcom banker and began investing in the wreckage. Downcycles are a natural part of capitalism—and an opportunity to build something better. I currently teach at Stanford's Graduate School of Business and am building something new for the green transition—this time with fewer marketing illusions and better foundations.Full bio on the Stanford website.

Commentary

FEATURED ESSAYS

The Secret Diary of a ‘Sustainable Investor’ (2021-2022)

• A viral essay series that broke open the ESG debate from an insider’s view. Later cited in media globally and used in business school courses.

Finance durable : contre l’instrumentalisation réactionnaire (Le Monde, April 2023)

• Commentary in Le Monde on the polarized ESG debate in the U.S.—how both the political left and right are distorting the conversation.

Sustainable Investing is a Deadly Distraction (The Globe and Mail, March 2021)

• Why Wall Street’s ESG practices fail to deliver meaningful climate impact—and may even delay real solutions.

Does Sustainable Investing Really Help the Environment? (Wall Street Journal, Nov 2021)

• Written debate with an ESG cheerleader on the hype and reality of ESG.

The Failure of Green Investing and the Need for State Action (The Economist, Nov 2021)

• Guest piece in the Economist debunking the ESG investing industry and plotting a path forward.SELECTED TALKS

“ESG + CRS = BS?”

• Stanford GSB talk with Bethany McLean and Prof. Anat Admati (Jan 2023)

“The Answer to Inconvenient Truths Isn’t Convenient Fantasies”

• Keynote at Voices by Business of Fashion (Dec 2022)

“Is ESG Investing a Dangerous Placebo?”

• New York Times Climate Forward Debate (June 2022)

“I’ve Seen the Worst of Capitalism—Here’s How We Fix It”

• TEDx Toronto talk (May 2022)SELECTED PODCAST APPEARANCES

“The Illusion of ESG Investing” (Prof G Show, March 2022)

“ESG investing is in need of a rethink” (The Economist, July 2022)

“Inside ESG: Hope or hype?” (Financial Times, Sept 2021)

Projects

Here’s what I’m working on right now:1. Teaching & Public Commentary

I teach a course on business and society at Stanford, drawing on experience across finance, tech, and policy. I also write and speak publicly on capitalism, society, and how the system really works—especially where it doesn’t.2. Free Microlearning

I chair the board of Rumie, a nonprofit I founded in 2013 that delivers quick and engaging micro-courses to young people on mobile phones. It’s where education, tech, and social impact meet—and Rumie’s millions of Gen Z learners keep me close to how younger generations think and learn.3. New Venture (Coming Soon)

I’m building something new in response to the ongoing downturn in green assets. More soon.

What people are saying:

“The part I enjoyed the most was Tariq’s overview of the markets. I came away from it grateful and inspired that people with these types of options decide that no, I’m going to try to do some good.” -Scott Galloway

“Tariq Fancy’s confessional essay is riveting.”

-The Economist

“With hindsight, Fancy looks less like a heretic and more like ESG’s Cassandra.”

-Financial Times

“Fancy’s insider revelations have drawn much-needed attention to industry abuses.”

-Bloomberg News

“The fact that incentives and structures may be too short-term to address society’s challenges is precisely the reason regulation is required, Fancy says. I agree.”

-Fortune

"Tariq Fancy once oversaw the beginning of arguably the biggest, most ambitious effort ever to turn Wall Street ‘green’ and has come to a stark conclusion: This is definitely not going to work."

-The Guardian

“It might sound saccharine from some, but Fancy is a man who speaks so clear-headedly about purpose that you can buy it.”

-CityAM

cited across the political spectrum:

-Jacobin

-National Review

“That’s what I like about you Tariq, you’re not about left or right—you’re about right or wrong.” - Anthony Scaramucci (aka "The Mooch")

Contact

Here's how to reach out:

Thank you

Thanks for reaching out!